Food & Climate

Australian company will debut cultured foie gras sell in Hong Kong, Six months after rolling out its cultured quail parfait in Singapore.

Startup Vow has been cleared to sell in Hong Kong at the Mandarin Oriental, according a report seen by “Food & Climate” platform.

Vow, a Sydney-based company, had plodded through more than 450 iterations to create a foie gras that it felt worthy of public scrutiny, said George Peppou, chief executive and co-founder.

Vow is not the only company placing bets on cultivated foie gras, but it’s the only one talking about its product right now, according to “The Washington post“.

The Paris-based Gourmey announced this summer that it had filed applications to sell lab-grown foie gras in five markets, including the United States, but the company declined to comment for this story. Like Gourmey, Vow is trying to enter the U.S. market, Peppou said, but given recent personnel changes at the U.S. Food and Drug Administration and the unknown regulatory landscape under the forthcoming Trump administration, the company is focused on other markets at the moment.

Cultured foie gras

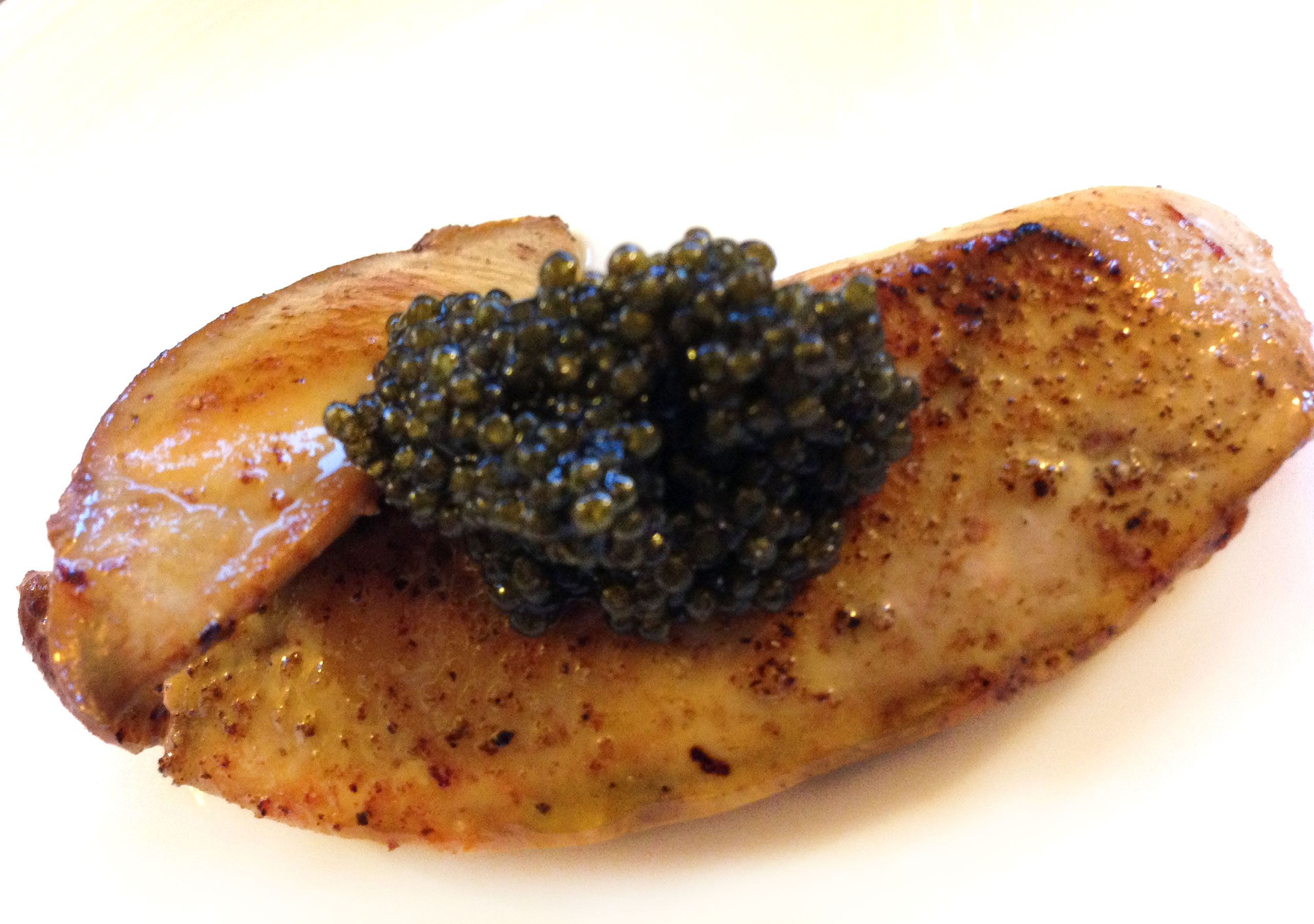

Vow will debut the cultured foie gras – sold under its Forged brand – at The Aubrey, an izakaya at the Mandarin Oriental, reveals co-founder and CEO George Peppou. “The Aubrey’s Japanese izakaya-style setting provides the perfect backdrop for showcasing our cultured Japanese quail products,” he tells Green Queen.

“Forged Parfait will feature in a dish exclusive to Hong Kong, served within smoke and topped with citric, yuzu and chives alongside brioche and pickles,” he says. The dish is priced at HK$388 ($49.85), with the option to add caviar for another HK$198 ($25.45).

For the launch month, a limited-edition cocktail will also be available to diners, costing HK$170 ($21.85). “Crafted by Devender Sehgal, the cocktail – titled ‘Senses’ – is a new take on an old fashioned, fat-washed with the Forged Gras to deliver a deep, rich flavour, complemented with herbal notes and a touch of nuttiness,” explains Peppou.

Forged Gras comprises 51% of Vow’s cultured Japanese quail, which lends the product a “rich umami and subtle gamey flavour”, Peppou says: “To achieve its luxurious texture and melt-in-your-mouth experience, we blend this with a thoughtful selection of ingredients – vegetable and herb-infused coconut oil, sunflower oil, and fava bean protein.”

Feeding birds against their will

The act of feeding these birds against their will and more than what they’d normally eat – frequently to 10 times their usual volume and in intensive farming settings – has spurred many cities and countries to ban foie gras production, including India, Argentina, Germany, Italy, and Turkey.

In France, too, 15 cities have outlawed the food.

But Vow isn’t just targeting the cruelty aspect with its cultured foie gras. In a 1,000-person survey, it found that of the 92% of American meat-eaters who hadn’t tried the delicacy, only 5% cite ethical reasons for not doing so.

So the company is hoping to offer a new flavour experience with Forged Gras, one that provides the gamey notes of Japanese quail with the texture of fatty liver. Its scalable production process, meanwhile, will make the product “accessible beyond the limits of scarcity”.

Unlike cultured meat companies such as Upside Foods and Good Meat, which have regulatory approvals to sell in the United States, Vow decided not to concentrate on chicken, the most commonly consumed protein in the country. Vow’s focus on foie gras, Peppou said, reflects the reality of lab-grown meats: The technological challenges and the high costs of production, together with the limited capacity of cultured-meat facilities, make it tough for companies to compete in markets where consumers expect abundance and low prices.

But even if Vow could overcome the obstacles and reach parity on price (and quality) with, for example, commodity beef producers, these high-tech newcomers would still have to deal with a potentially hostile marketplace, Peppou said.

If parity is reached, “what’s the beef industry going to do?” Peppou asked. “They’re going to use their massive pricing power and their massive regulatory influence to make it really hard for you to win in the market or really hard to get any kind of foothold in the market.”

There may be another benefit to entering the foie gras market: Vow’s internal research suggested that less than 10 percent of Americans have tried foie gras. Such a low number would suggest that, unlike with chicken or pork or beef, most consumers don’t have years of experience to compare against a lab-grown version.